Individual Health Insurance Plans

Shopping for your own health insurance can feel like a daunting task. The Health Insurance Marketplace has a myriad of plans available to NC residents, and people we talk to often say it’s hard to fully understand how plans differ.

That’s where we can help.

Speak with an agent:

Our team is always reviewing available plans; we know the nuances and can recommend ideal options for your specific needs. We can also save you time and money navigating healthcare.gov and verifying your subsidy eligibility.

You don’t pay any additional fees for your healthcare plan when working with an agent.

Working With a Health Insurance Agent Is Ideal For:

- When you are self employed

- When you work for someone else, but your job does not provide health insurance

- You want help navigating the healthcare system

- You are retired and must now seek your own healthcare plan

Major Considerations When Shopping For Individual & Family Healthcare Plans

Understanding how these aspects of your healthcare plan works help ensure you make a choice that gives you and your family everything you’ll need throughout the year.

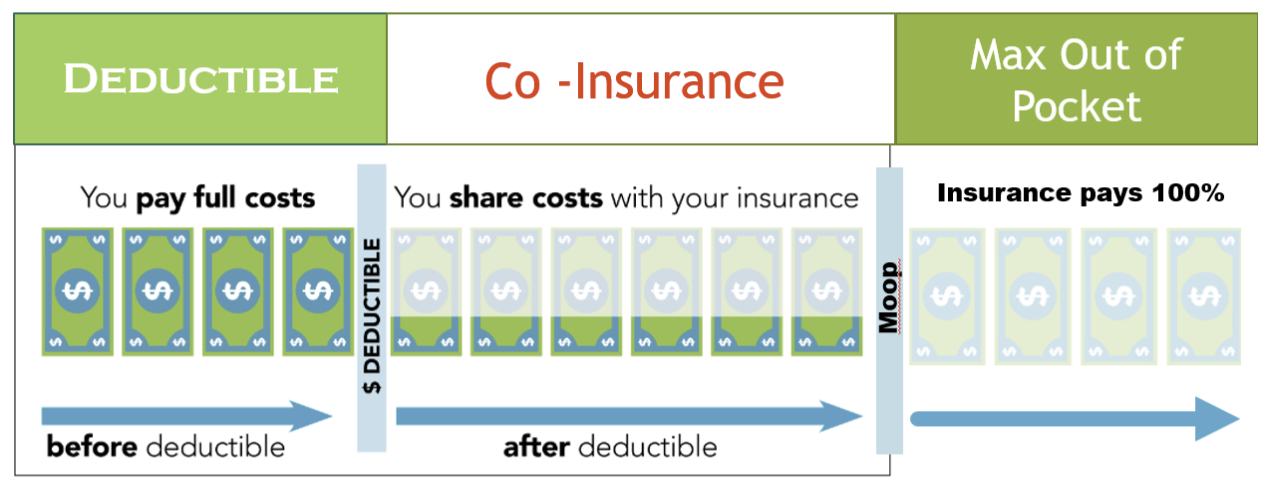

There are 3 stages to health care plans:

The deductibles are how much you’ll need to pay out of pocket throughout the year before your insurance provider covers for more significant medical visits and surgeries. For instance, if you have a $5,000 deductible it would mean that you need to have contributed that amount toward medical costs that visit, or throughout the year up until that visit, before your insurance plan covers its portion of the total.

Different plans offer various options for deductibles. Some plans offer lower deductibles, meaning the plan begins covering more of the total fees sooner, but those plans are also more costly each month.

Copayments are the amount you pay toward any doctor’s office or hospital visits, after which your insurance provider covers the remaining fee. Often your plan will have specific copayments specified for routine medical visits, such as exams, sick visits, and specialist visits.

Annual Maximums or Max Out of Pocket are the threshold where you are done paying for medical expenses, and your healthcare plan pays 100% of covered medical claims. If you expect to have major surgeries or are concerned about enough coverage should that arise, these are something to ask your insurance agent about.

Speak with an agent:

Preventative Care Is Often Covered 100%

Visits such as wellness visits, blood screenings, and vaccines are often fully covered by insurers. This is a huge benefit for you, and insurers offer this because keeping you healthier lowers everyone’s costs.

This coverage is great for everyone, but especially helpful if you have a little one. Babies and toddlers receive several vaccinations over the first 2 years, and certain vaccines can cost hundreds of dollars a piece without coverage. Having good health coverage can save you significantly in those first couple years.